Knight

Well-known Member

U.S. deficit to soar to record $3.8 trillion in 2020, budget watchdog group saysWASHINGTON (Reuters) -

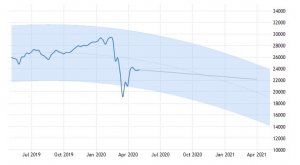

A steep economic downturn and massive coronavirus rescue spending will nearly quadruple the fiscal 2020 U.S. budget deficit to a record $3.8 trillion, a staggering 18.7% of U.S. economic output, a Washington-based watchdog group said on Monday.

Releasing new budget estimates based on spending mandated by law, the Committee for a Responsible Federal Budget (CRFB) also projected that the fiscal 2021 deficit would reach $2.1 trillion in 2021, and average $1.3 trillion through 2025 as the economy recovers from damage caused by coronavirus-related shutdowns.

“These projections almost certainly underestimate deficits, since they assume no further legislation is enacted to address the crisis and that policymakers stick to current law when it comes to other tax and spending policies,” the group said in a statement.

CRFB’s projections also assume the economy experiences a strong recovery in 2021 and fully returns to its pre-crisis trajectory by 2025.

https://www.reuters.com/article/us-...2020-budget-watchdog-group-says-idUSKCN21V1TA

It's going to be interesting to see what will happen in the form of taxes to reduce the deficit.

A VAT is proposed so that everyone will share in reduction. IMO that is the fairest solution. Only exception to that would be that congress removes the VAT once the deficit is under control. Fat chance that would happen though.

A steep economic downturn and massive coronavirus rescue spending will nearly quadruple the fiscal 2020 U.S. budget deficit to a record $3.8 trillion, a staggering 18.7% of U.S. economic output, a Washington-based watchdog group said on Monday.

Releasing new budget estimates based on spending mandated by law, the Committee for a Responsible Federal Budget (CRFB) also projected that the fiscal 2021 deficit would reach $2.1 trillion in 2021, and average $1.3 trillion through 2025 as the economy recovers from damage caused by coronavirus-related shutdowns.

“These projections almost certainly underestimate deficits, since they assume no further legislation is enacted to address the crisis and that policymakers stick to current law when it comes to other tax and spending policies,” the group said in a statement.

CRFB’s projections also assume the economy experiences a strong recovery in 2021 and fully returns to its pre-crisis trajectory by 2025.

https://www.reuters.com/article/us-...2020-budget-watchdog-group-says-idUSKCN21V1TA

It's going to be interesting to see what will happen in the form of taxes to reduce the deficit.

A VAT is proposed so that everyone will share in reduction. IMO that is the fairest solution. Only exception to that would be that congress removes the VAT once the deficit is under control. Fat chance that would happen though.

:max_bytes(150000):strip_icc()/Amadeo-Closeup-582619cd3df78c6f6acca4e6.jpg)