On AARP>>

Next year could bring the biggest increase to Social Security benefits in four decades, with rising prices fueling forecasts of a nearly double-digit cost-of-living adjustment (COLA) for 2023.

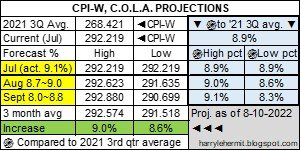

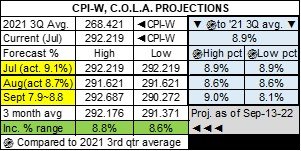

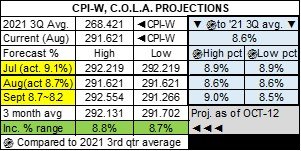

The inflation gauge used by the Social Security Administration (SSA) to set the annual COLA came in at 9.1 percent for July — the first of three months the agency uses to determine the final figure, slated to be announced in October. Any increase in benefits would take effect in January 2023.

“It’s not possible to be precise until we see the data for the next two months, but it’s probably safe to say at this point we can expect a COLA in the 8 to 10 percent range,” says David Certner, legislative counsel and director of legislative policy for government affairs at AARP. That would be the biggest increase since 1981, when the COLA was 11.2 percent.

Any estimates are preliminary; the actual COLA will depend on changes in consumer prices through the end of September. A 9 percent COLA would boost the average Social Security retirement benefit by about $150 a month in 2023.

“I think somewhere in the 9 percent range is probably a reasonable guess,” says Richard Johnson, director of the retirement policy program at the Urban Institute, a Washington, D.C.-based research organization.

Johnson notes that July’s inflation rate dipped slightly from June’s. “If that trend continues, we’re looking at about an 8.6 percent COLA, but it could be a little higher,” he says. “It’s hard to predict exactly how, in particular, energy prices are going to evolve over the next few months. I think that’s probably the big uncertainty.”

Economist Bill McBride, in his Calculated Risk blog, estimates a similar range of 8.5 percent to 9 percent. Josh Gordon, director of health policy for the Committee for a Responsible Federal Budget, a nonpartisan fiscal policy think tank, predicted 9.9 percent “if things continue on trend” but says the COLA could be around 8.9 percent “if we had no more inflation for the rest of the year.”

The 2022 COLA of 5.9 percent increased the average retirement benefit by $92 a month. In 2021, payments grew by an average of $20 a month on the back of a 1.3 percent adjustment.

A rise in Medicare Part B premiums in 2023 would offset a portion of the COLA increase for Social Security recipients who have Medicare premiums deducted directly from their benefit payments (as is the case with about 70 percent of Part B enrollees). However, the 2023 Part B premium increase is expected to be smaller than this year’s record increase. Medicare typically reveals the following year’s premium prices in October, around the time the SSA announces the new COLA.

Next year could bring the biggest increase to Social Security benefits in four decades, with rising prices fueling forecasts of a nearly double-digit cost-of-living adjustment (COLA) for 2023.

The inflation gauge used by the Social Security Administration (SSA) to set the annual COLA came in at 9.1 percent for July — the first of three months the agency uses to determine the final figure, slated to be announced in October. Any increase in benefits would take effect in January 2023.

“It’s not possible to be precise until we see the data for the next two months, but it’s probably safe to say at this point we can expect a COLA in the 8 to 10 percent range,” says David Certner, legislative counsel and director of legislative policy for government affairs at AARP. That would be the biggest increase since 1981, when the COLA was 11.2 percent.

Any estimates are preliminary; the actual COLA will depend on changes in consumer prices through the end of September. A 9 percent COLA would boost the average Social Security retirement benefit by about $150 a month in 2023.

“I think somewhere in the 9 percent range is probably a reasonable guess,” says Richard Johnson, director of the retirement policy program at the Urban Institute, a Washington, D.C.-based research organization.

Johnson notes that July’s inflation rate dipped slightly from June’s. “If that trend continues, we’re looking at about an 8.6 percent COLA, but it could be a little higher,” he says. “It’s hard to predict exactly how, in particular, energy prices are going to evolve over the next few months. I think that’s probably the big uncertainty.”

Economist Bill McBride, in his Calculated Risk blog, estimates a similar range of 8.5 percent to 9 percent. Josh Gordon, director of health policy for the Committee for a Responsible Federal Budget, a nonpartisan fiscal policy think tank, predicted 9.9 percent “if things continue on trend” but says the COLA could be around 8.9 percent “if we had no more inflation for the rest of the year.”

The 2022 COLA of 5.9 percent increased the average retirement benefit by $92 a month. In 2021, payments grew by an average of $20 a month on the back of a 1.3 percent adjustment.

A rise in Medicare Part B premiums in 2023 would offset a portion of the COLA increase for Social Security recipients who have Medicare premiums deducted directly from their benefit payments (as is the case with about 70 percent of Part B enrollees). However, the 2023 Part B premium increase is expected to be smaller than this year’s record increase. Medicare typically reveals the following year’s premium prices in October, around the time the SSA announces the new COLA.