Roadwarrior

Member

Here we go again, about a year ago I posted a thread about my FICO score dropping over 60 points. It happened again after this Feb close, a 66 point drop on Transunion. I have no mortgage, no auto loans, no personal loans, two debit cards (pension & credit union), no inquiries & 2 years ago I acquired a low limit ($500) unsecured MasterCard (only open account) for online orders & to play the rewards game. It started with a $35 annual fee that they waived last Mar because I had kept the balance low (8%) or paid off.

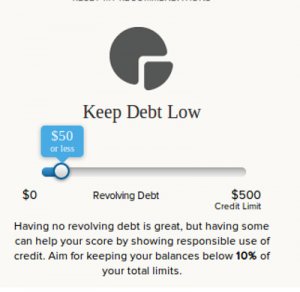

This year I didn't want to get my balance above the 8% at the monthly close so I paid it down to 0 in Feb. It was reported as zero owed ($0). When I posted my concern last year some of the members said they had never heard of that, and I must be mistaken or should check my report for errors - I did, nothing was amiss. I kept track of the '17 rewards received ($65) - worth the effort but requires a little head work. I don't know if they will waive the fee again but my thoughts go back to the drop in my FICO, the reporting agency reported that I had paid off a credit card as the reason that caused my drop. It's all a game and the credit card issuers want to keep you in debt so they play a numbers game on you. I read somewhere that if you have zero debt & a paid off card it goes against you (something to do with debt availability).

This goes along with the thoughts I posted about seniors & credit cards trying to play the rewards game & not getting a 'gotcha' from the issuers. I will still maintain the card for online orders & reservations but it's not a game I enjoy in my 'golden' years. A good FICO score is important for auto insurance, rentals & whatever. So a drop like that could affect my rates, try to explain that on your applications, no one understands the game.

NOTE: If I remember it took a little over 3 months to get it back close to the original score, but I had to carry a little debt along the way.

This year I didn't want to get my balance above the 8% at the monthly close so I paid it down to 0 in Feb. It was reported as zero owed ($0). When I posted my concern last year some of the members said they had never heard of that, and I must be mistaken or should check my report for errors - I did, nothing was amiss. I kept track of the '17 rewards received ($65) - worth the effort but requires a little head work. I don't know if they will waive the fee again but my thoughts go back to the drop in my FICO, the reporting agency reported that I had paid off a credit card as the reason that caused my drop. It's all a game and the credit card issuers want to keep you in debt so they play a numbers game on you. I read somewhere that if you have zero debt & a paid off card it goes against you (something to do with debt availability).

This goes along with the thoughts I posted about seniors & credit cards trying to play the rewards game & not getting a 'gotcha' from the issuers. I will still maintain the card for online orders & reservations but it's not a game I enjoy in my 'golden' years. A good FICO score is important for auto insurance, rentals & whatever. So a drop like that could affect my rates, try to explain that on your applications, no one understands the game.

NOTE: If I remember it took a little over 3 months to get it back close to the original score, but I had to carry a little debt along the way.