Robert59

Well-known Member

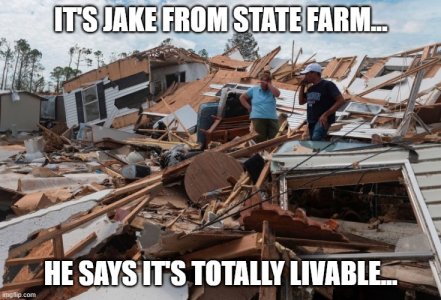

Thursday where he spoke about the devastation left by Hurricane Ida, and the need for insurance companies to take care of their policyholders. While some companies, like Allstate and USAA, have agreed to cover some additional costs, State Farm has reportedly refused to cover any extra costs for homeowners who were not under a mandatory evacuation order.

https://www.yahoo.com/entertainment...coverage-hurricane-ida-victims-064537123.html

https://www.yahoo.com/entertainment...coverage-hurricane-ida-victims-064537123.html