mellowyellow

Well-known Member

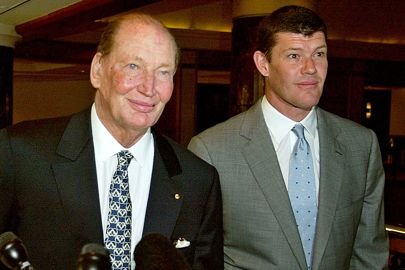

Kerry Packer, once said

I am not evading tax in any way, shape or form. Of course I am minimising my tax. Anybody in this country who does not minimise his tax wants his head read.

Billionaires like Warren Buffett pay a lower tax rate than millions of Americans because federal taxes on investment income (unearned income) are lower than the taxes many Americans pay on salary and wage income (earned income).

Because Buffett gets a high percentage of his total income from investments, he pays a lower income tax rate than his secretary. Currently, the top statutory tax rate on investment income is just 23.8%, but it’s 43.4% on income from work.

https://americansfortaxfairness.org...-booklet/fact-sheet-taxing-wealthy-americans/

Can’t find a date on this article but it helps me understand a bit better as to why the rich don’t pay the same tax rate as ordinary people. And, by the way, it still stinks.

Last edited: