Harry Le Hermit

Member

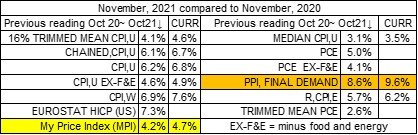

The CPI was released this morning. 6.8% was within the expected range of 6.6% to 6.9%. With it came a lot of other indexes being released and I threw mine in due to inflated ego, I guess. So pick one you like or wait until near end of the month when all the others pop up.

Of course, this is all in the rear view mirror and the current $64,000 question (6,678, in 1958 dollars) is the direction going forward. With last December at a 260.474 reading and the current at 277.948, merely staying flat would make the next reading at 6.7%. Energy seems to be easing, but will it be enough to hold off increases in other areas? Smarter minds than me indicate 7.0% ~ 7.2%. A lot of that is base effect, as the month to month is slated to ease to 0.4%. For the history buffs, June, 1982 year over year inflation was reported at 7.1%. Were they really the "good ole days"?

Real Earnings were also released and showed a monthly drop, -0.4% or back to March, 2020 level.

Of course, this is all in the rear view mirror and the current $64,000 question (6,678, in 1958 dollars) is the direction going forward. With last December at a 260.474 reading and the current at 277.948, merely staying flat would make the next reading at 6.7%. Energy seems to be easing, but will it be enough to hold off increases in other areas? Smarter minds than me indicate 7.0% ~ 7.2%. A lot of that is base effect, as the month to month is slated to ease to 0.4%. For the history buffs, June, 1982 year over year inflation was reported at 7.1%. Were they really the "good ole days"?

Real Earnings were also released and showed a monthly drop, -0.4% or back to March, 2020 level.