OneEyedDiva

SF VIP

- Location

- New Jersey

I received an email from Discover saying my SS had been found on the Dark Web. Discover sends out monthly emails, that up until the last one, said my number was not found on any dark web sites. The advice was to freeze my credit, which I had done years ago and to initiate a fraud alert with Experian. I wondered why they didn't say to also do it with Trans Union and Equifax. I found out when I added the fraud alert, that Experian sends the request to the other two agencies. Still I did it on Trans Union myself. My Equifax account is a PITA to get into; they want me to jump through hoops, mail information to them, etc. so I didn't bother.

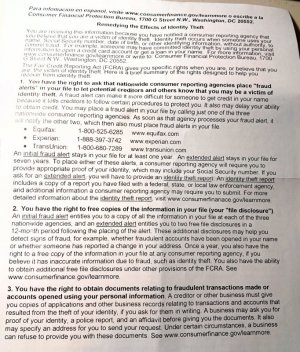

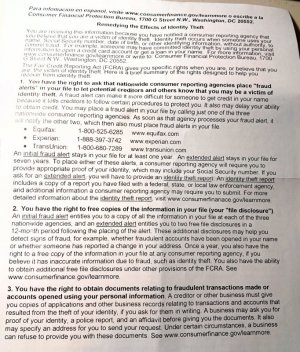

What is the difference between a credit freeze and fraud alert. A credit freeze is supposed to stop anyone from being able to obtain credit in your name. I have lifted the freezes on mine for one day each time I applied for a new credit card. The purpose of a fraud alert is explained below, I received this along with a letter from Experian. I never informed them that I was the victim of identity theft but with our SS numbers out there and now mine being on the dark web, it's a possibility.

What is the difference between a credit freeze and fraud alert. A credit freeze is supposed to stop anyone from being able to obtain credit in your name. I have lifted the freezes on mine for one day each time I applied for a new credit card. The purpose of a fraud alert is explained below, I received this along with a letter from Experian. I never informed them that I was the victim of identity theft but with our SS numbers out there and now mine being on the dark web, it's a possibility.

Last edited: