Harry Le Hermit

Member

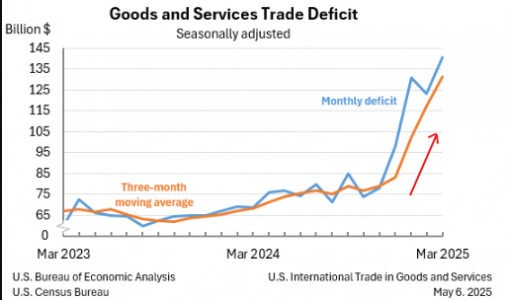

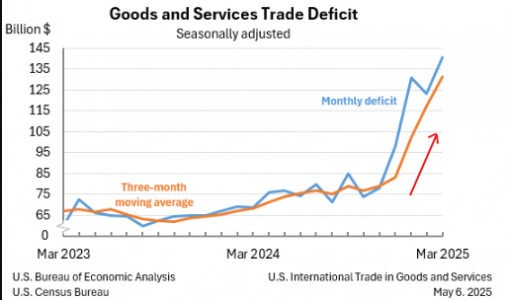

A stab at a discussion of foreign trade number, with a look at the U.S. trade deficit.

U.S. International Trade in Goods and Services, March 2025 | U.S. Bureau of Economic Analysis (BEA)

Obviously, the front loading of imports prior to impending tariffs, were a major reason for the negative GDP number, by about -1.3%.

Opinions...

U.S. International Trade in Goods and Services, March 2025 | U.S. Bureau of Economic Analysis (BEA)

Obviously, the front loading of imports prior to impending tariffs, were a major reason for the negative GDP number, by about -1.3%.

Opinions...

- I would expect the 2nd release later this month to reflect a downward revision.

- A lot of talk about ship sailings decreasing, but that should be expected after the front loading. Even the Year over Year is currently down 10%, but very likely due to that front loading.

- Most FTZs and Bonded Warehouses are much fuller than usual.

- As the deficit acts as a drag on GDP, the 2nd quarter will be much improved, as that front loading has largely ended.

- On the inflation front, I have read the effective tariff on all goods, is likely about 20% above one year ago. Coupled with a 6% decline in the USD, the likely impact is about an added 1.25% to inflation at 25% pass through, and 5% at 100% pass through. The consumer will decided the pass through rate.