I maintain a spreadsheet where I enter the amount of gas and electric I use each day on one worksheet, then on three other worksheets I summarise the gas usage per month, the electric usage per month, and the total usage per month. On the last one I also have 3 monthly rolling summaries, 6 monthly rolling summaries, and an annual rolling summary.

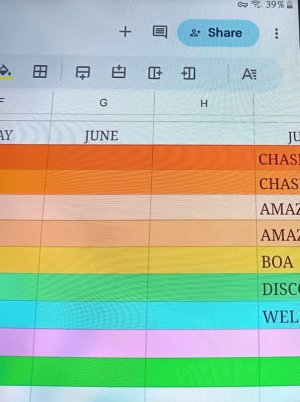

Other than that I just keep track of my monthly spending either by going on to my bank website to see all the recent transactions, or onto the credit card website to see my recent transactions. That way I know when there are big direct debits coming up and if necessary I'll move money into my current account to cover the credit card cost. I always pay the complete amount, so I never pay any interest on my credit card, but as it's a Tesco's credit card, I also accumulate loyalty points that I can put toward meals out and other items.