Ruth n Jersey

Well-known Member

- Location

- Northern New Jersey

We have had AARP for quite few years now and as insurance goes its been pretty good as our supplement to Medicare.

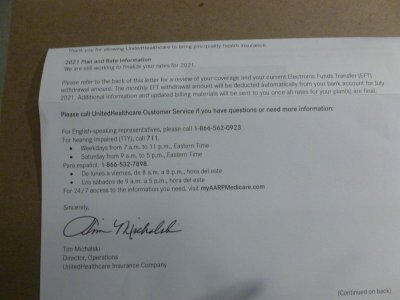

I'm wondering if any of you have gotten the new rates? We keep getting notices in the mail saying they are working on it.

I hope when they finally get it straightened out the rates won't be astronomical.

Any idea what is going on?

I'm wondering if any of you have gotten the new rates? We keep getting notices in the mail saying they are working on it.

I hope when they finally get it straightened out the rates won't be astronomical.

Any idea what is going on?