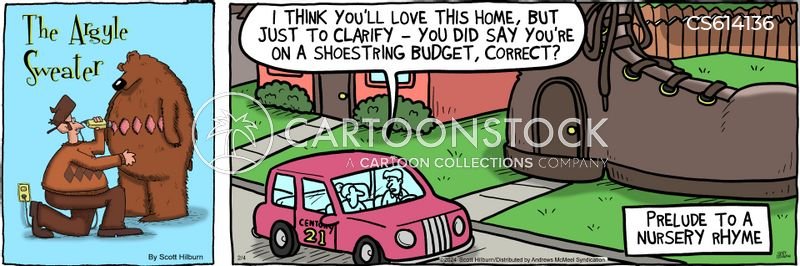

We OK. Not living on a shoestring per se.

Although we married later (59) we both separately - before we even met - each planned fairly well for retirement and we are so glad we EACH did.

We both do try to be thrifty, conserving money as much as possible for rainy days and our bigger planned purchases.

We do have a $2,900.00/month house payment for a bit still though. We also own (free and clear) a 4-acre house lot in a more secluded rural NE side of Tucson (Tanque Verde) that has a spectacular up close and personal view of the mountains. When we were younger, we had considered building a house on the lot, I drew up the plans, had soils tests, engineering certified, etc; but Covid nixed that idea.

Now we will sell that 4 acres when the right buyer comes along, in the next few years, and pay off our house.

Both of us are 100% covered by both VA TFL (both of us are veterans) as well as Medicare. We don't have any pharmacy costs to speak of as

we are both fairly healthy rolling into 70; and praying to God we both stay that way.