mathjak107

Well-known Member

- Location

- bayside ,queens , ny

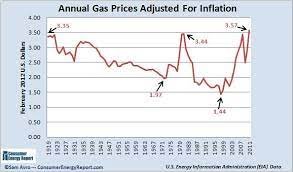

3% inflation as an average is normal and that is what bond markets are predicting …they have historically been correct In setting their own bond rates

in 2006 -2007 the fed was raising short term rates ..the bond market disagreed and bid rates lower on bonds while the fed was raising rates ….the bond market smelled trouble and we ended up have the famous inverted yield curve where short term rates ended up higher then long term rates .

the bond market was correct , and the feds inflation fears were unfounded and they now had to lower rates again.

raising rates will take what ever money people have to spend and suck it away like a tax would …that will leave less money to be spent on goods and services and that will likely slow us down and tip us towards recession…

the fed will likely have to reverse course and may never even get to implement all the increases it sees doing

in 2006 -2007 the fed was raising short term rates ..the bond market disagreed and bid rates lower on bonds while the fed was raising rates ….the bond market smelled trouble and we ended up have the famous inverted yield curve where short term rates ended up higher then long term rates .

the bond market was correct , and the feds inflation fears were unfounded and they now had to lower rates again.

raising rates will take what ever money people have to spend and suck it away like a tax would …that will leave less money to be spent on goods and services and that will likely slow us down and tip us towards recession…

the fed will likely have to reverse course and may never even get to implement all the increases it sees doing

Last edited: