mathjak107

Well-known Member

- Location

- bayside ,queens , ny

not what i am saying .Please consider what you are saying before accusing fire fighters.

the people in the building were pretty sure the stuff was taken during the evacuation by the fire department and have filed charges.

anything is possible and i wouldn’t put it passed anyone to do such a thing .

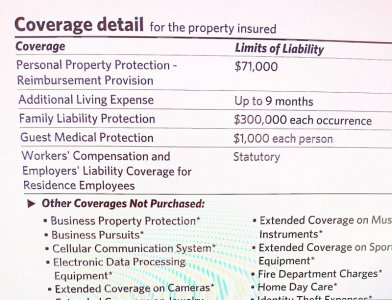

but the point is there is an example of why renters insurance is a good idea no matter who took it