But are we really in it for the long haul? How many years is 'the long haul'?

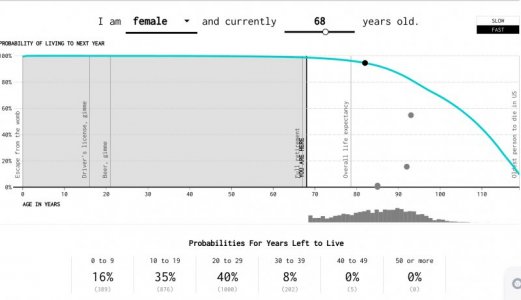

If I consider 30 yrs to be the long haul, I only have an 8% chance of living that long, and since I'm retired the majority of my money will be spent sooner (if I was aiming to 'die with zero' I'd be spending 33% in the next 7 years I guess).

Plus I only have a few years of cash-equivalents, so I'm not in a position to significantly 'buy the dips', and at risk of having to sell in down markets.

Twice in my lifetime the stock market went 'sideways' (up and down but not exceeding the starting point), once it was sideways for

11 years and another time for

13 years.

If we enter a new decade of sideways market, that would be at least half of my remaining years.

Gee, I'm starting to think I need to change my asset allocation to a more conservative one.

View attachment 361097

View attachment 361098