Brookswood

Senior Member

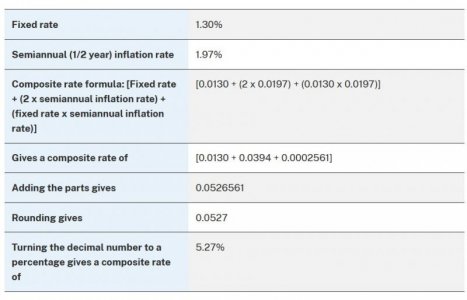

It’s hard to know for certain what will happen in May when the new rates for Ibonds are set, but it now appears that the current Ibond fixed rate of 1.3% probably won’t get much if any better starting May 1. But, that is not certain and anybody who tells you they know for certain what the Treasury Dept will do is a fool or a liar, IMO.

I picked up this years allocation of Ibonds. I think 1.3% plus inflation is a pretty good rate these days for a long-term stash of cash. I keep Ibonds for emergency and/or big needs sometime in the future. I don’t care them for short term money since they can’t be sold for one year from the date of purchase. And, the seller forfeits three months of interest if the bonds are sold before being held five years. But, for a long term stash of cash to put towards the new deck you will need or as an emergency fund, I think they are find in a well diversified portfolio.

IOW, if you agree with me that earning 1.3% plus the rate of inflation is desireable for some of your longer term savings, then you might want to purchase your Ibonds before the end of the month.

I picked up this years allocation of Ibonds. I think 1.3% plus inflation is a pretty good rate these days for a long-term stash of cash. I keep Ibonds for emergency and/or big needs sometime in the future. I don’t care them for short term money since they can’t be sold for one year from the date of purchase. And, the seller forfeits three months of interest if the bonds are sold before being held five years. But, for a long term stash of cash to put towards the new deck you will need or as an emergency fund, I think they are find in a well diversified portfolio.

IOW, if you agree with me that earning 1.3% plus the rate of inflation is desireable for some of your longer term savings, then you might want to purchase your Ibonds before the end of the month.