Ed B

New Member

- Location

- Weatherford Texas

I need some growth in my 401k and with current market instability and the limited options in my company's 401k plan funds I don't see many good options. I have about $275k currently. I will have a company pension that I will receive when I retire that will replace about 40% of my current gross income. And I plan to take SocSec at 62 since men in my family don't live long lives. So my 401K assets will only provide a small percentage of monthly retirement revenue along with some occasional travel/vacation money while in retirement.

Since August 2015 I got out of equities and split my savings 65/35 with 65% in high quality AAA and AA US bonds that return about 2.5 % with average term of bonds being 3 to 6 years, and 35% in Stable value. I make a little in the way of investment performance from the bond fund but this is basically my "under the mattress" strategy.

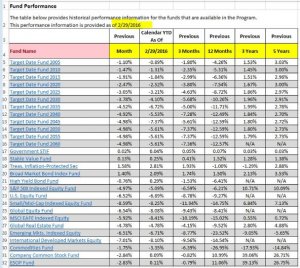

That all said my financial adviser says the stable value portion is being just plain chicken. But even she says my company's plan doesn't offer many good options. So after some thought I am moving the money out of stable value fund and splitting that sum up with half of that going into my existing Bond fund; 35% in an S&P 500 Indexed Equity Fund and 15% in my company's stock (lmt). This is still a very conservative approach but I have little confidence in the equity markets right now and only marginal confidence in highly rated US bonds. Once I figure out how I will post an image that shows my fund options and their performance over the past month, three months, year to date, last 12 months, last 3 years and last 5 years,

I am curious what others in similar situations are investing in and how it is working for.

Thanks in advance.

Since August 2015 I got out of equities and split my savings 65/35 with 65% in high quality AAA and AA US bonds that return about 2.5 % with average term of bonds being 3 to 6 years, and 35% in Stable value. I make a little in the way of investment performance from the bond fund but this is basically my "under the mattress" strategy.

That all said my financial adviser says the stable value portion is being just plain chicken. But even she says my company's plan doesn't offer many good options. So after some thought I am moving the money out of stable value fund and splitting that sum up with half of that going into my existing Bond fund; 35% in an S&P 500 Indexed Equity Fund and 15% in my company's stock (lmt). This is still a very conservative approach but I have little confidence in the equity markets right now and only marginal confidence in highly rated US bonds. Once I figure out how I will post an image that shows my fund options and their performance over the past month, three months, year to date, last 12 months, last 3 years and last 5 years,

I am curious what others in similar situations are investing in and how it is working for.

Thanks in advance.

Last edited: