Looks like Knight already gave you an answer, but I had been working on a reply, so I'm posting it anyway.

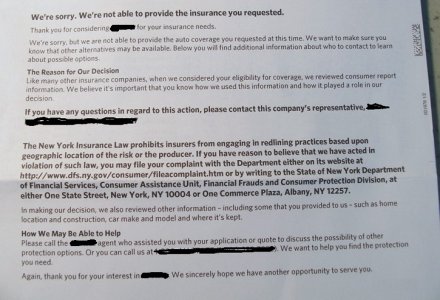

In the letter, under this section: "

The Reason for Our Decision,"it states, "Like many other insurance companies, when we considered your eligibility for coverage, we reviewed consumer report information."

That usually refers to adverse information obtained from the Credit Bureau, such as a change in credit score, but there could be other reasons we don't know about, since the letter isn't specific.

Insurance companies must comply with the

Fair Credit Reporting Act. When a credit report (consumer report) leads to an adverse action such as denying coverage, you have the right to a notice explaining the decision. That letter does not meet the requirements.

You said your last coverage ended Sept. 15th, so this notice apparently applies to your renewal that occurred on or about the same date. They should have made their determination prior to renewal instead of processing your payment and waiting to notify you of their decision later. If their decision is final, and you have no coverage, you are due a refund, and will need to find other options - probably another insuror.

I was once refused a renewal by an insurance company years ago, but was notified in advance, not after the fact.