OldFeller

Well-known Member

- Location

- Pennsylvania, USA

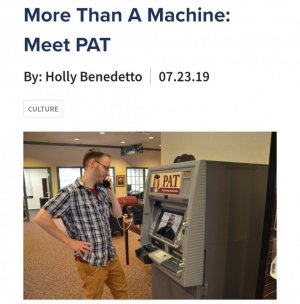

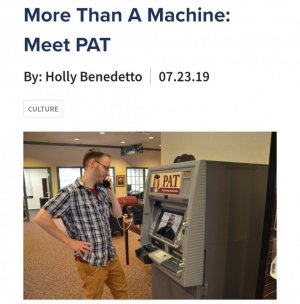

My credit union branch has replaced the bank tellers with a machine that enables you to call a teller who is at some central location and converse over video chat. Any document like drivers license is scanned. Personal checks get inserted into a slot.

Receipts are printed out.

It wasn't offered as an option but instead I was told to process my transaction (pay my credit card balance) at the machine.

Receipts are printed out.

It wasn't offered as an option but instead I was told to process my transaction (pay my credit card balance) at the machine.