Don M.

SF VIP

- Location

- central Missouri

Especially if you live in the Northeast...

https://www.yahoo.com/finance/news/going-pretty-bad-part-us-180842963.html

https://www.yahoo.com/finance/news/going-pretty-bad-part-us-180842963.html

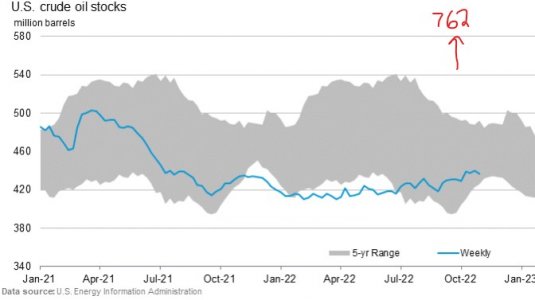

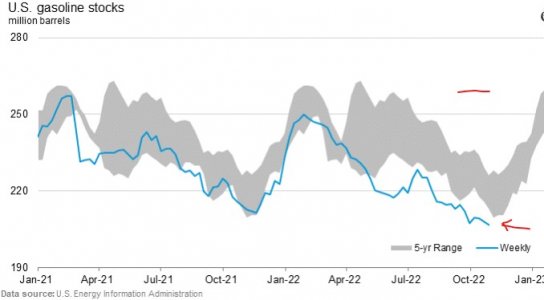

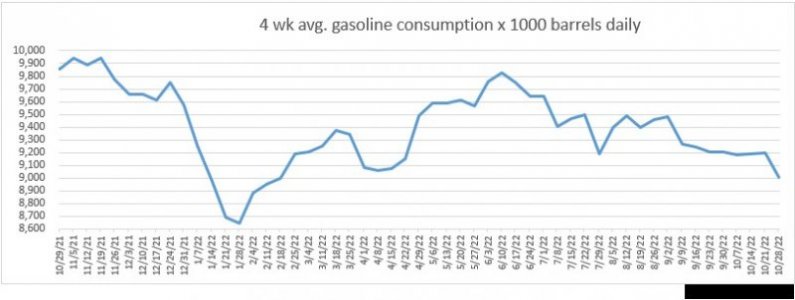

I haven't seen any bids in that range and would be a bit hesitant in believing some oil trader's wishful thinking. There is actually a glut in crude currently... the problem is refining cannot process enough to meet consumer demand.There are crude oil futures bids being placed in the $150+/barrel range. Between this Ukraine mess, and the reductions in fossil fuels production, and not enough solar, etc., to compensate, energy costs are going to rise substantially....for everyone.

It seems that there are a few traders who are bidding on these prices rising next year.I haven't seen any bids in that range and would be a bit hesitant in believing some oil trader's wishful thinking.

Options. Not obligations on physical delivery.It seems that there are a few traders who are bidding on these prices rising next year.

https://www.barrons.com/articles/brent-crude-oil-prices-futures-51667596998