debodun

SF VIP

- Location

- way upstate in New York, USA

I suppose some people's went up even more. They are tacking a "library tax" onto the regular tax.

A year or month?I suppose some people's went up even more. They are tacking a "library tax" onto the regular tax.

Just as an aside bit of info,I received my STAR refund check in the mail this morning. Of course, it's too late to take it to the bank. Now I won't be able to deposit it until Monday. It was for $1080.66, so that lowers my school taxes to $1463.67.

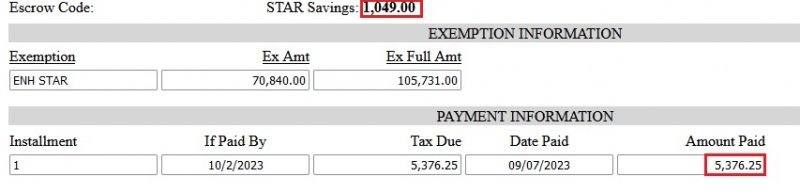

A friend of mine pays over $5000 in just school tax and that's WITH her STAR exemption (see screen shot). She owns a lot of vacant land which she doesn't even use. I told her she should sell it to lower her taxes, but she just gave me a "mind your own business" look.

View attachment 303895

Some States do not have direct deposit set up for all of their programs, especially ones that change.I'm surprised the STAR program doesn't have direct deposit. When I looked at the NYS tax page, it indicated that they are going to start that next year, but anyone wanting to enroll in that had to sign up for an account. I tried several times, but it just kept giving me a pop-up that said the info they had on file didn't match what I was entering. Well, I tried.

So, which US state ranks dead last, in terms of poor educational outcomes for the kids in that State ? JimB.I pay my taxes. And i do not quibble…but darn it my state ranks about 48th or so for schools in the nation…and that drives me friggin crazy…

I do not believe this is correct for all or even most states. . It's low-income seniors who get a break. And when they say low income they really mean LOW income. Lower middle class gets zero, zip, nada property tax relief in my sate.I would think in just about every state, seniors get a homestead exemption reducing their property taxes.