OneEyedDiva

SF VIP

- Location

- New Jersey

"Don’t have a cash reserve? Here are some ways to adjust your spending and withdrawals to help ease the burden on your portfolio"

Charles Schwab

Charles Schwab

This looks like the standard rhetoric."Don’t have a cash reserve? Here are some ways to adjust your spending and withdrawals to help ease the burden on your portfolio"

Charles Schwab

For a lot of people, especially those skittish about the markets, peace of mind is very important. And I ain't even mad at 'em. After all, we know that next to stock returns, banks pay next to nothing, thus the value of that cash actually declines significantly over time. Since my portfolio is somewhat aggressive, I know I probably have more in savings than I should, but I feel better knowing it's there. As of today, my savings and checking accounts make up 20.51% of my retirement portfolio.while cash reserves sound good , research has shown it really adds nothing except some mental comfort .

spending directly down from stocks and bonds has actually done better then having a cash bucket .

remember in down turns it isn’t equities that are sold , it’s bonds to rebalance.

as kitces points out

EXECUTIVE SUMMARY

For retirees who fear the impact of a market downturn on their spending, an increasingly popular strategy is just to hold several years of cash in a reserve account to accomplish near-term spending goals. As the logic goes, if there are years of spending money already available, the portfolio can avoid selling equities in a down market to raise the required cash, and clients don't have to sweat where their retirement income distributions will come from while waiting for the markets to recover.

Yet the mathematics of rebalancing reveals in the truth, even clients following a standard rebalancing strategy don't sell equities in down markets, rendering the cash reserve strategy potentially moot. On the other hand, some benefits still remain - although aside from an indirect short-term tactical bet, the most significant impact of a cash reserve strategy may be more mental than real.

Is A Retirement Cash Reserve Bucket Unnecessary?

exactly.The problem with reducing expenses is that eventually you run out of things to cut especially with everything going up in price.

it is really about allocation and volatility , not about whether you have cash buckets .For a lot of people, especially those skittish about the markets, peace of mind is very important. And I ain't even mad at 'em. After all, we know that next to stock returns, banks pay next to nothing, thus the value of that cash actually declines in value, significantly over time. Since my portfolio is somewhat aggressive, I know I probably have more in savings than I should, but I feel better knowing it's there. As of today, my savings and checking accounts make up 20.51% of my retirement portfolio.

You said that you were down 100k as of the other day. As of today, I'm down a little over $44,000. Total gain is listed ad 36.98% though, so I'm nowhere near panic mode (which I don't do anyway). My BFF told me a good friend of hers lost millions as of Friday. I know he had bought a whole lot of shares of NVDIA (in addition to his other holdings), but I was under the impression he had gotten them at a lower price than what they dropped to over the last couple of days. Nvidia is down about $24 per share over the average cost I paid. Don't have that many shares though.

on the other hand a penny saved is a penny earned , but it will always be a penny without good compounding ."I'm not so much interested in the return ON my money as I am in the return OF my money.” — Quote by Will Rogers.

I'm satisfied with the 3.85% that my CD's from my credit union are paying.

we need to do both in retirement.I would rather cut expenses than assume more risk in an effort to increase income.

The market doesn’t care what any of us want or need and running out of income would be worse for me than restricting expenses.

Being able to cut expenses is good, but if there's no cash stash, what happens if a person has to move or absolutely needs to buy another vehicle to get back and forth to work? What if prices rise so high, as is expected with these tariffs, that cutting back no longer helps because there's nothing else that can be cut?IMO reducing day to day expenses and limiting draws on retirement portfolios is much better than relying on a cash reserve.

Better to structure a budget around a 2-3% draw and then squeeze out a lump sum during good times. It would probably still work out to the conventional logic of 4% draw without having to sell in a down market.

I do agree that a cash savings plan is important for repair and replacement during retirement.

In the end we all have to find a system that works for our situation.

If you know you have more money than you need for the rest of your life. The mental comfort of cash reserves is very valuable.while cash reserves sound good , research has shown it really adds nothing except some mental comfort .

i agree , i like the feeling of a cash bucket .If you know you have more money than you need for the rest of your life. The mental comfort of cash reserves is very valuable.

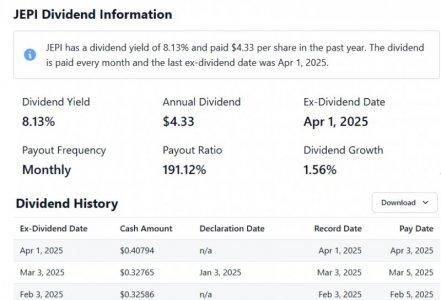

jepi is not in the same class as cash instruments.

it has lost 5.38% including all interest ytd and lost over 6% just in the last week.

not a place someone looking at cash instruments should be .

JPST would be more appropriate

there are loads of long / short funds today since the sec approved hedge fund strategies for etfs and funds in 2020 .

but none , not even something like SWAN which is 90% treasuries and 10% LEAPS is a proxy for cash instruments

who cares what the yield is .

with all divide included it lost over 5 % this year .

bad deal . you lost money not gained a penny

NEVER CHASE YIELD , IT IS ONLY ABOUT YOUR TOTAL RETURN

jpst has a ytd return of 1.11% so far , compared to losing over 5% in jepi

for the week jpst lost .30% , jepi lost 6.13%.

jepi is as volatile as a junk bond fund. no way should anyone buy that as a replacement for their cash instruments .

buy it as you would a junk bond fund , it’s that volatile but no way does that belong as a proxy for cds or money markets

they are fools if they chase yield .People who care about monthly and yearly income care about the yield, and btw, if this looks like a volatile stock to you, then I think you need a reality check.

View attachment 415950