Colleen

Senior Member

- Location

- Pennsylvania

Our online bank that we have mainly for savings has CD rates currently at 3% for a 3-year term. Would this be a good time to open a CD at this rate or would something else be better?

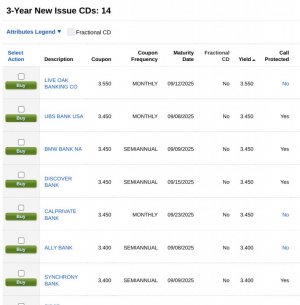

I glanced at CDs being offered and it looks like you could do better than 3% (a lot offered at 3.4%), but I'm still learning about all these finance things and I'm not sure what the 'call protected' status means for CDs, I would have thought all CDs were call protected but I guess not...open a CD at this rate or would something else be better?