Pappy

Living the Dream

Won’t even begin to cover the increase in my car insurance and house insurance. Oh well, better than nothing.

You may not need it but I sure to. I depend on my yearly raise (COLA) to cover at least partially my upcoming rent increase.Everyone wants an increase every year. But do we really need it? We keep reading and hearing about the Social Security fund will soon be depleted. If they keep giving us raises every year, won't that make the SS fund become depleted sooner? Why not wait a few years? I for one can accept that. Then again, I'm a cheapskate that doesn't spend a lot of money.

There are too many who depend on SS as their sole income. The last stat I saw was 40% but that from a couple of years ago. It has been proven that SS COLAs don't really keep up with inflation, so if there were no increases at all, it would be even harder for those who depend on this income to survive. The average SS benefit is $1,872. If someone was living in N.J. and couldn't get into senior housing, they'd be hard pressed to even find a one bedroom apartment for that amount, let alone have enough for groceries and medical care.Everyone wants an increase every year. But do we really need it? We keep reading and hearing about the Social Security fund will soon be depleted. If they keep giving us raises every year, won't that make the SS fund become depleted sooner? Why not wait a few years? I for one can accept that. Then again, I'm a cheapskate that doesn't spend a lot of money.

There are only so many ways to push that insolvency date down the road, and that last minute is now, imho. However, all the options are politically untenable, and that timeline will be shortened, when the FED starts reducing interest rates. It would also be reduced if taxes on Social Security were removed.Some on this forum feel that there will be a last minute "hail Mary"

That's not even close with keeping up with inflation...plus they will probably charge us more for the Meicare InsuranceThe article is to long to post in it's entirety

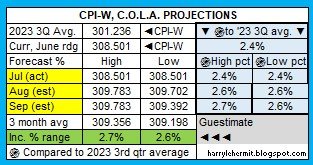

The Senior Citizen League (TSCL), a nonprofit advocacy group, estimated last month that Social Security benefits would get a 2.7% cost-of-living adjustment (COLA) in 2025.

That forecast was recently revised lower because inflation cooled more than anticipated in May. Social Security benefits are now on pace to get a 2.6% COLA next year, according to TSCL statistician Alex Moore. That aligns with the estimate from the Social Security Board of Trustees.

MSN

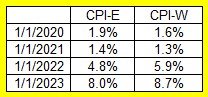

I would be suspicious of congress doing anything and likely would get it wrong. I would be a proponent of CPI-E over CPI-W... IF the historical gap is closed with either a one time catch-up or over a period of a couple of years.I learned something about COLA yesterday. For decades, SSA has been using the wrong calculation to arrive at the proper cost of living increase, cheating seniors out of a lot of money, and both the House and Senate know it. They've been talking for years about requiring SSA to use the correct method of calculation - CPI-E, which is for Americans 62 and older, instead of CPI-W, the metric currently used, which is for wage-earners - and it seems they're finally going to get around to it ...soon.

This guy explains it very clearly here (8-min video):

The point, or objective, would be to ensure that the COLA be realistically in step with the actual cost of living. I highly doubt that would include a one-time catch-up. More likely, a clean-slate and denial of any gap instead, and we wouldn't benefit, but future seniors would ...IF the SS program would even be sustainable after switching to CPI-E. Despite its age, there's also a possibility the COLA benefit would die and be replaced by some ingenious alternative program.I would be suspicious of congress doing anything and likely would get it wrong. I would be a proponent of CPI-E over CPI-W... IF the historical gap is closed with either a one time catch-up or over a period of a couple of years.

Just jumping to CPI-E gives a mixed outlook, as seen in the chart, which includes annual increases of the official, against CPI-E...

View attachment 370821

Yes, in 2022 and 2023, the raise would have been much smaller than current. There has been similar instances throughout the years. A person drawing $900 in 1998, would be drawing about $70 more this year if using CPI-E. However, during that same period, that peson would have pocketed $11,500 more.

I'm so glad I made a Roth conversion when I did. That was back in the day when "experts" said if you didn't make a certain amount (which I didn't) converting wouldn't be worth it. To me that was backward thinking. Why would I want to pay taxes on investments when my retirement income would be lower? My Roth, which has grown nicely, now makes up 67% of my investments and my traditional IRA only 6%. My RMDs from that are qualified charitable deductions, so it winds up that I don't pay taxes on 73% of my investments.Right now I'm a lot more worried about IRMAA (Medicare premiums) and the SS tax torpedo. I have 401(k) money that I worry about RMDs on as well. Then throw in the expiring tax cuts after 2025... the future could get expensive.

COLAs almost don't even matter compared to the big tax hit coming. Getting Roth conversions going is about the only thing I can do aside from making big qualified charitable contributions to at least have say over where the tax money goes.

I was thinking the definitive percentage would be released soon. At least it's fairly close to the earlier estimates.Yesterday in the news, was the SSA release of the 2025 COLA value of 2.5%.

That's interesting. I usually get notifications by email from SSA too, but haven't gotten that one yet. Considering the $10+ rise in the Medicare premium, I calculated a $27/mo net increase.Just received an official email from the SSA with a link to log on to view the new numbers. However the last time I logged onto my SSA account with their supposed new security features last year, it was ridiculously annoying difficult, endlessly going around in circles blindly through web pages without adequate directions, having to repeatedly login. Eventually succeeded using an IDme account.

Sorry, but can we even expect anything administered by 'the government' to happen in time, reasonably or logically? Hey, I'm not saying the thing has to be replaced but more as something to laugh at (if one can roust up the patience) and then stoically plod along through it.Just received an official email from the SSA with a link to log on to view the new numbers. However the last time I logged onto my SSA account with their supposed new security features last year, it was ridiculously annoying difficult, endlessly going around in circles blindly through web pages without adequate directions, having to repeatedly login. Eventually succeeded using an IDme account.

The increase should be in your first 2025 check.I hope the increase is effective prior to January 20th.