Knight

Well-known Member

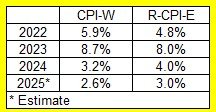

TSCL believes Social Security benefits have lost 20% of their purchasing power since 2010 because COLAs have failed to keep pace with inflation. The root cause of that problem is the CPI-W, and the situation will likely deteriorate further in 2025.

To elaborate, the CPI-W considers inflation across eight major product groups, which are weighted based on workers' spending patterns. But workers are usually young and tend to spend money differently than retired workers on Social Security. For instance, retirees generally spend more on housing and medications and less on transportation and education.

MSN

To elaborate, the CPI-W considers inflation across eight major product groups, which are weighted based on workers' spending patterns. But workers are usually young and tend to spend money differently than retired workers on Social Security. For instance, retirees generally spend more on housing and medications and less on transportation and education.

MSN