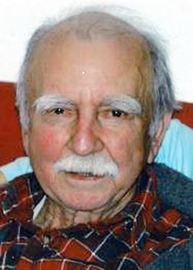

Ronald James Read was an American philanthropist, investor, janitor, and gas station attendant. Read grew up in Dummerston, Vermont, in an impoverished farming household. He walked or hitchhiked 4 mi daily to his high school and was the first high school graduate in his family.

"A community in Vermont was surprised in 2015 when Ronald Read, a retired gas station attendant and janitor, turned out to have been worth nearly $8 million upon his death — and left about $5 million to his local library and hospital".

"How Read amassed such a vast sum may or may not surprise you, but you probably will be surprised that someone of modest means, who didn’t have a fancy job, could grow so wealthy. You may also be happy to learn that the strategies he employed are ones we can use, too". (Read More)

"

Last edited: