Harry Le Hermit

Member

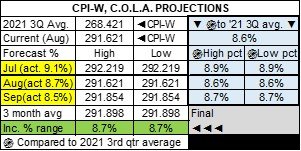

The CPI-U and CPI-W will be published at 8:30AM on the 13th, by the BLS. With that information the rest easily calculable per Federal Law. If I am awake, I will post the results. This is the link... https://www.bls.gov/news.release/cpi.htm. Note: it currently has September numbers, but changes tomorrow AM. CPI-W reading of 291.078~291.882 yields 8.7%; 291.883~292.687 yields 8.8%.A few months ago there was talk of a lower Medicare premium due to the adjustment for the new Alzheimer's drug that was priced lower than expected. This is what I read today...our basic premiums will be lowered from $170.10 to $164.90. @Kaila @Harry Le Hermit

https://www.cms.gov/newsroom/fact-s...s-2023-medicare-part-d-income-related-monthly

Also Harry, in articles I read today from a couple of different sources, the prediction is 8.7%. We should find out soon, if not tomorrow when it's slated to be announced...by Friday 10/14.

The 8.7% COLA is wishful thinking and would indicate the FED might backpedal, as the month over month would be -0.2%~+0.1%.

The 8.8% COLA is likely based on most forecasts of +0.1%~+0.4%. 8.9% COLA is not out of the realm of possibility. But hey, all things will be known tomorrow AM.

BTW, Why in post #24 are you repeating what I had in post #21, from September 27th?