Here is some interesting information from the State of New York:

Garage sales and other similar sales

Most garage sales are not subject to the sales tax registration requirements and the sellers are usually not required to collect sales tax. However, Tax Law section 1115(a)(18) specifically provides that if certain conditions are not met, you may need to collect sales tax, or possibly register for sales tax purposes. See

TSB-M-80(9)S,

1980 Legislation-Changes in Dollar Limitation of "Garage Sale" Receipts.

The conditions that must be met under Tax Law section 1115(a)(18) to avoid registration and sales tax collection are:

- The sale is at your home.

- Neither you (the seller) nor any member of your household is in a trade or business selling similar items. For example, if you own a store where you sell antiques and are registered to collect sales tax, your spouse cannot sell antiques from your home without also registering to collect sales tax.

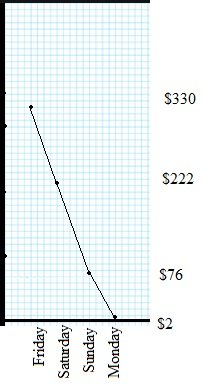

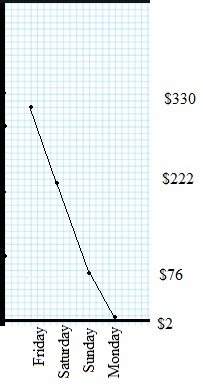

- You make sales for three days or less in a calendar year. Sales on the fourth and subsequent days are subject to tax.

- You do not expect your sales to exceed $600 in a calendar year. If actual sales unintentionally exceed $600, the first $600 in any calendar year is exempt. (See Occasional sales from your home (casual sales), explained above, You must collect sales tax, and may have to register as a vendor, if the sales you are making are:

- more frequent than allowed by these exemptions,