I got my renewal bill from The Hartford and of course it went up. I then got a quote from Allstate and I would save $330 or about 25% but it’s still difficult for me to switch. What I have now is all set up and I pay annually and can forget about it for a year. In my experience you get a low ball first quote after which it keeps going up and over the course of time you don’t save anything. Still pondering.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Home & Auto Insurance

- Thread starter Chet

- Start date

Don M.

SF VIP

- Location

- central Missouri

I've had State Farm auto insurance for decades. Every couple of years, I visit one of these web sites that "compares" auto insurance, and usually find that I would save little or nothing by switching companies. About all I accomplish by checking rates is to get a huge increase in bogus e-mails and phone calls. Plus, I like the fact that SF has a physical human insurance agent nearby, in case I do need to file a claim....instead of calling an 800 number, and speaking to an agent in India.

Aunt Bea

SF VIP

- Location

- Near Mount Pilot

I have GEICO.

I know that I could save money by switching.

I've had great results with GEICO, customer service, claims, and roadside assistance.

I'm content to stay where I am.

I know that I could save money by switching.

I've had great results with GEICO, customer service, claims, and roadside assistance.

I'm content to stay where I am.

squatting dog

Remember when... thirty seemed so old.

- Location

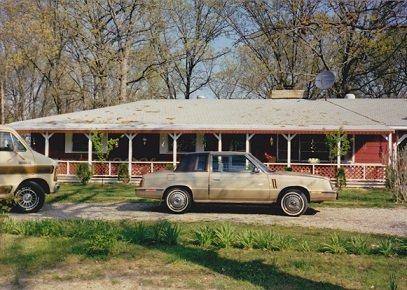

- Arkansas, and also Florida

My story about state farm is a might different. For years, I had state farm on the house and all my vehicles. Then, I got them to insure my tow truck and storage yard. Then, the wife opened a computer store next to the house with a breezeway in between. Well, agent came and made sure we got a business coverage policy.I've had State Farm auto insurance for decades. Every couple of years, I visit one of these web sites that "compares" auto insurance, and usually find that I would save little or nothing by switching companies. About all I accomplish by checking rates is to get a huge increase in bogus e-mails and phone calls. Plus, I like the fact that SF has a physical human insurance agent nearby, in case I do need to file a claim....instead of calling an 800 number, and speaking to an agent in India.

Fast forward a couple of years. My house catches fire. (never want to see that again). Kitchen, dining room, living room, roof, and bathroom are all burned along with basement where main breaker box is located. Add to that, water and smoke damage throughout the rest of the house. Call good old state farm. Agent comes right away. surveys all the damage and leaves. Next day a large dumpster and a cleanup crew show up to gut the damaged stuff. Now comes the good part.

We have no electric until the wiring and main box are replaced so I asked him about what to do with the computer store. Now he says that having a breezeway makes the store considered part of the house, so no coverage there. (??? odd... they never said that when they came and wrote the policy). Next big shock. Total amount of their check is $66,000, of which $33,000 goes to the cleanup grew.

So, I'm supposed to have a house re-built for $33,000 dollars. (anyone priced what a kitchen alone costs?) Now, the house was insured with replacement cost coverage , so, if totaled, it would mean $175,000 dollars. Well, they don't consider it totaled and I'm stuck with a mere $33k to try and rebuild.

Needless to say, the next day all my insurances were changed to another company.

A postscript. I'm pretty handy and I tried to re-build, by doing all but the electrical ($10k) myself. I got some done, but, the problem of water soaked basement caused abnormal amounts of mold and the wife couldn't breath in the house unless the windows were open. Maybe someday I'll tell the story of what happened next, but, for now, that's enough.

oldpeculier

Member

I've switched several times over the years chasing that first year or two savings. Been with USAA for several years now thinking they won't screw a veteran...

Yeah, I know.

Those companies know when the renewal is due because I always start getting mailings from all of them. Look here! Save $400 on your homeowners, etc. etc.

Yeah, I know.

Those companies know when the renewal is due because I always start getting mailings from all of them. Look here! Save $400 on your homeowners, etc. etc.