You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If you think we've seen the worst in the stock market

- Thread starter seadoug

- Start date

AnneTeak

Member

- Location

- Boston, MA

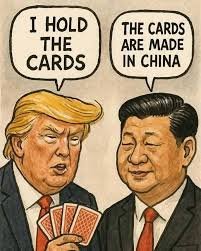

or...it might have been the plan all along as in insider trading. throw out a distraction like tariffs and buy on the dip.

NotCompSavvy

Senior Member

- Location

- Florida

How true that is .or...it might have been the plan all along as in insider trading. throw out a distraction like tariffs and buy on the dip.

Warrigal

SF VIP

- Location

- Sydney, Australia

It's early down here (9.30am) and there is an uptick happening here too - ASX up 2.35% so far.

My retirement fund is still down by roughly $16,000 at this point.

The ASX will take quite a lot of time to crawl back up to where I was last month.

My retirement fund is still down by roughly $16,000 at this point.

The ASX will take quite a lot of time to crawl back up to where I was last month.

Last edited:

Are you buying?It's early down here (9.30am) and there is an uptick happening here too - ASX up 2.35% so far.

U.S. stock S&P went up > 9% in one single today.

Warrigal

SF VIP

- Location

- Sydney, Australia

No, I am not buying. My superannuation is in a managed fund. I have a balanced portfolio that I am leaving alone.Are you buying?

U.S. stock S&P went up > 9% in one single today.

I have been reading The Drudge Report via SKY NEWS UK though. It is an interesting read.

Trump and his treasury secretary have made it a key policy priority to lower yields. For a while, it looked like the plan was working - but Trump may have spoken too soon.

Gurpreet Narwan

Business and economics correspondent @gurpreetnarwan

Wednesday 9 April 2025 18:00, UK

Just this weekend, after US stock markets suffered their sharpest falls since the onset of the pandemic, Trump reposted a video on his social media platform Truth Social. This was its title: "Trump is purposefully CRASHING the market."

The video claimed the president was engineering a flight to US government bonds, also known as treasuries - a safe haven in turbulent times. The video suggested Trump was deliberately throwing the stock market into chaos so investors would take their money out and buy bonds instead.

Why? Because demand for treasuries pushes up the price of the bonds, and that, in turn, lowers the yield on those bonds. The yield is the interest rate on the debt, so a lower yield pushes down government borrowing costs. That would provide some relief for a government that has $9.2trn of government debt to refinance this year. Consumers also stand to benefit as the US Federal Reserve, the US central bank, would likely follow suit, feeling the pressure to cut interest rates.

Trump and his treasury secretary, Scott Bessent, have made it a key policy priority to lower yields. For a while, it looked like the plan was working. As stock markets tumbled in response to Trump's tariffs agenda, investors ploughed their money into bonds instead.

However, Trump may have spoken too soon. On Monday, the markets had a change of heart and rapidly started selling government bonds. Thirty-year treasury yields hit 4.92% on Wednesday, their biggest three-day jump since 1982. That means government borrowing costs are rising - and not just in the US. The sell-off has spiralled to government bonds worldwide.

This is a big deal. It is the sharpest sell-off in the US bond market since the pandemic. Back then, investors also rushed into bonds before dumping them and the motivations, on one level, are similar.

In 2020, investors sold bonds because they had to cover losses elsewhere in their portfolios. When markets fall, as they have done over the past few days, lenders can demand that an investor who has borrowed money stump up more cash against the value of their loan because the collateral against those loans has fallen in value. This is known as a "margin call". Government bonds are easy to sell as investors "dash for cash".

There are other forces weighing on government bonds. With policy uncertainty unfolding in the US, investors could also be signalling that US debt isn't the safe haven it once was. That loss of confidence also seems to have hurt the dollar, one of the world's safest places to park your money. It's had a turbulent journey but is down 1.15% against a basket of safe haven currencies since Trump announced widespread tariffs on 2 April.

Is there method to the madness amid market chaos? Why Trump would have you believe so

Warrigal

SF VIP

- Location

- Sydney, Australia

For Ukrainians stock markets are the least of their worries. They are at risk of losing their country, their freedom, and for many others, their very lives. Some Ukrainians already have lost their children to Russia.meanwhile, what happens to the Ukraine War would end in 24 hours? Seems like nobody is talking about it anymore.

Remembering this, I cannot complain very much about losing some of my retirement savings.

OneEyedDiva

SF VIP

- Location

- New Jersey

Exactly Marie. And this is just the beginning.I want to point out that all this fuss isn't just about the stock/bond markets. We have pissed off EVERYONE and it is affecting people's livelihoods. Our state of Maine relies heavily on the tourist industry. There have been several local news articles here about how so many people (mostly foreign) have canceled their summer reservations. One hotel owner in Ogunquit (beach town) is practically empty moving forward. We have seen several restaurants close around us too. "Our" arrogant attitude towards our allies is hurting a lot of people just trying to make a living.

mathjak107

Well-known Member

- Location

- bayside ,queens , ny

this is a global issue that’s wont be resolved quickly .

the damage isn’t even known yet but any tariffs at all will raise prices here in america to an already stretched consumer .

pkus that can mean higher rates as foreign countries are demanding more interest to buy our bonds

the damage isn’t even known yet but any tariffs at all will raise prices here in america to an already stretched consumer .

pkus that can mean higher rates as foreign countries are demanding more interest to buy our bonds

Aunt Bea

SF VIP

- Location

- Near Mount Pilot