Don M.

SF VIP

- Location

- central Missouri

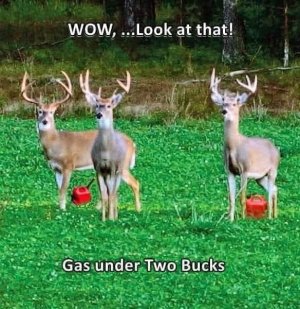

The financial news reports were full of reports today, regarding the CPI for July falling .5% since June...Whoppe-De-Doo! The CPI, however, doesn't seem to include the prices of food and energy. While it's true that gasoline prices have come down a bit in recent weeks, those savings have been offset by the rising costs of food.

We did our weekly grocery shopping today, and while I'm pushing the cart, I look closely at the prices. Virtually everything we normally buy was up in price in just the past week. The most notable was a 4lb. pack of sugar....last week it was $2.10...today $2.79. About the only thing that seemed to be a bargain was avocados....last week $1.10, this week .89.

It's going to take a whole lot more of "balancing" the prices of consumer goods before I believe that inflation is slowing down.

We did our weekly grocery shopping today, and while I'm pushing the cart, I look closely at the prices. Virtually everything we normally buy was up in price in just the past week. The most notable was a 4lb. pack of sugar....last week it was $2.10...today $2.79. About the only thing that seemed to be a bargain was avocados....last week $1.10, this week .89.

It's going to take a whole lot more of "balancing" the prices of consumer goods before I believe that inflation is slowing down.