perChance

Member

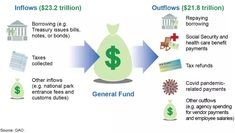

There is a third option - politicians can stop wasting money.When facing shortfalls the solutions are to either reduce benefits (including by raising retirement age), increase funding (raise taxes or borrow), or a combination of these.