You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The stock market is taking a dive today!

- Thread starter SeniorBen

- Start date

The news said it is because of the Credit Suisse problems, but I don't think that bank's problems should be a surprise, one of the bond traders on the early retirement forum mentioned months ago that Credit Suisse had serious problems and to avoid its bonds, but I think he also said they were too big to be allowed to fail.

My portfolio is bouncing up and down a lot, I refreshed a few minutes apart three times, and once it was up a couple thousand, then the next it was down almost two thousand, then the third time it was up a hundred.

The stock price of the company I retired from last year has dropped a couple dollars (seven dollars since the banking problems started), but on the other hand, in spite of dropping it is still more than 18% higher than last year.

My portfolio is bouncing up and down a lot, I refreshed a few minutes apart three times, and once it was up a couple thousand, then the next it was down almost two thousand, then the third time it was up a hundred.

The stock price of the company I retired from last year has dropped a couple dollars (seven dollars since the banking problems started), but on the other hand, in spite of dropping it is still more than 18% higher than last year.

Disgustedman

Senior Member

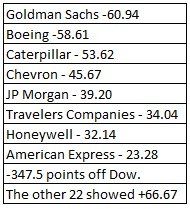

31,475.23 - 680.17 down 2.13%The DOW is down 683.73 right now.

This could be the beginning of the economic collapse!

calm down chicken little

Gaer

"Angel whisperer"

- Location

- New Mexico U.S.A.

I like you Disgusted man! hahahahaha!31,475.23 - 680.17 down 2.13%

calm down chicken little

Last edited:

Harry Le Hermit

Member

It happens, when overweighted companies hit a bump.

Glass half full. Bargain hunting time.

Don't have a lot to spend but I'm going to look at as a fire sale, everything has to go(not literally). I got some good deals in after the apocolypse was announced and markets crashed. Looking for more now. Barn burner Black Friday stampede door busters-any spotted yet?

Should note I have a CS mutual fund which should survive since it consists of other people's stock/money. Stay calm, don't panic. Panic selling bad but don't let 'panic' turn into frantic buying.

Don't have a lot to spend but I'm going to look at as a fire sale, everything has to go(not literally). I got some good deals in after the apocolypse was announced and markets crashed. Looking for more now. Barn burner Black Friday stampede door busters-any spotted yet?

Should note I have a CS mutual fund which should survive since it consists of other people's stock/money. Stay calm, don't panic. Panic selling bad but don't let 'panic' turn into frantic buying.

stretch5881

Member

- Location

- Wisconsin

This retreat was started by the Silicon Valley Bank and them being heavily invested in crypto. That sparked a slide in the bank sector just by association. Then comes the computer generated sell by the big financial institutions. It's exciting, isn't it?

Disgustedman

Senior Member

I want to see jumpers. If they ain't jumping, it's no big dealThis retreat was started by the Silicon Valley Bank and them being heavily invested in crypto. That sparked a slide in the bank sector just by association. Then comes the computer generated sell by the big financial institutions. It's exciting, isn't it?

SeniorBen

Senior Member

I'd call it interesting more than "exciting."This retreat was started by the Silicon Valley Bank and them being heavily invested in crypto. That sparked a slide in the bank sector just by association. Then comes the computer generated sell by the big financial institutions. It's exciting, isn't it?

I've never been good at predicting what the economy is going to do. It seems like one day it's starting to tank and then it goes on a tear. I moved my 401k into an IRA several years ago. Had I left it alone, it would have more than doubled.

I've never been good at predicting what the economy is going to do. It seems like one day it's starting to tank and then it goes on a tear. I moved my 401k into an IRA several years ago. Had I left it alone, it would have more than doubled.

Sounds like you are qualified to join the fund management team of my target-year-retirement mutual fund!

OneEyedDiva

SF VIP

- Location

- New Jersey

The Dow has been down more than that over the past months. By the closing bell, it had only lost 280.83 points. Most of my investments don't follow the Dow, so I don't worry so much about its numbers.

Murrmurr

SF VIP

- Location

- Sacramento, California

Same here.The Dow has been down more than that over the past months. By the closing bell, it had only lost 280.83 points. Most of my investments don't follow the Dow, so I don't worry so much about its numbers.

I withdrew/sold/cashed-out all my investments 3 years ago, right before I got married. I did it so I could use the money for other things, like buying our house and stuff, but it just happened to be good timing. I didn't make a killing, but I did pretty well, and I'm glad I don't have to even think about all that now. (my advisor did most the sweating, but still...)

Nathan

SF VIP

- Location

- High Desert- Calif.

I really haven't been following the Silicon Valley bank thing, so being heavily invested in crypto-currency was a factor? No big surprises here.This retreat was started by the Silicon Valley Bank and them being heavily invested in crypto. That sparked a slide in the bank sector just by association. Then comes the computer generated sell by the big financial institutions. It's exciting, isn't it?

I don't "watch" or consume any structured news programs, I just keep my finger on the pulse of the internet. If the WWW lights up with chatter then I investigate. A guy at the gym was telling me about how he rushed to the nearest ATM to check if his bank was still solvent, was all upset. I know that he follows a certain cable 'news' station, so no big surprises there either.

stretch5881

Member

- Location

- Wisconsin

Yup, people are moving their funds to banks that do not have much to do with digital currency.I really haven't been following the Silicon Valley bank thing, so being heavily invested in crypto-currency was a factor? No big surprises here.

I don't "watch" or consume any structured news programs, I just keep my finger on the pulse of the internet. If the WWW lights up with chatter then I investigate. A guy at the gym was telling me about how he rushed to the nearest ATM to check if his bank was still solvent, was all upset. I know that he follows a certain cable 'news' station, so no big surprises there either.

Lewkat

Senior Member

- Location

- New Jersey, USA

Good grief, it has a long way to go before panic sets in.

Harry Le Hermit

Member

hearlady

Homebody

- Location

- N Carolina

There's one thing I try to keep in mind. Both republicans and democrats invest in the stock market so they both have a reason to work together to keep the markets healthy.

That in turn helps us keep our investments somewhat safe.

That in turn helps us keep our investments somewhat safe.

Geezer Garage

Senior Member

- Location

- Steamboat Springs CO

The difference being they know ahead of time when to bail.

There's one thing I try to keep in mind. Both republicans and democrats invest in the stock market so they both have a reason to work together to keep the markets healthy.

That in turn helps us keep our investments somewhat safe.

Brookswood

Senior Member

And the above could be a lot of nonsense.The DOW is down 683.73 right now.

This could be the beginning of the economic collapse!

Brookswood

Senior Member

Actually SVB was too heavily invested in long term treasury bonds yielding very low interest rates. IOW, they did the banking equivalent of buying Hi and selling Low. Then their depositors were too cheap to workout safer ways to,protect their savings. Idiots! So now the rest of us get to bail them out again.I really haven't been following the Silicon Valley bank thing, so being heavily invested in crypto-currency was a factor? No big surprises here.

I don't "watch" or consume any structured news programs, I just keep my finger on the pulse of the internet. If the WWW lights up with chatter then I investigate. A guy at the gym was telling me about how he rushed to the nearest ATM to check if his bank was still solvent, was all upset. I know that he follows a certain cable 'news' station, so no big surprises there either.

Brookswood

Senior Member

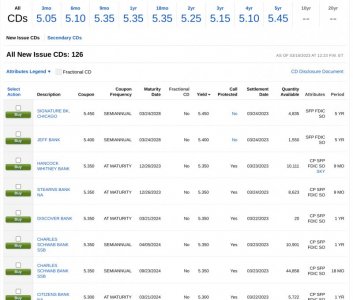

As one of the little people the best thing I can do in regards to banking and the stock market is not much. Except buy some of those 5% CDs being offered.

Don M.

SF VIP

- Location

- central Missouri

Most of the "guru's" have been predicting a looming Recession for the past several weeks/months. This banking issue is just another problem that may well prove them right. This is a good time to be invested in fairly conservative assets.

I like to follow the CBOE VIX as an indicator as to where the markets are heading. During good times, the VIX usually holds in the mid-teens. Lately, the VIX has stayed well above 20, and today it reached over 26....which is a good indicator of risky markets.

I like to follow the CBOE VIX as an indicator as to where the markets are heading. During good times, the VIX usually holds in the mid-teens. Lately, the VIX has stayed well above 20, and today it reached over 26....which is a good indicator of risky markets.

Nathan

SF VIP

- Location

- High Desert- Calif.

5% CDs? Where?As one of the little people the best thing I can do in regards to banking and the stock market is not much. Except buy some of those 5% CDs being offered.