You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

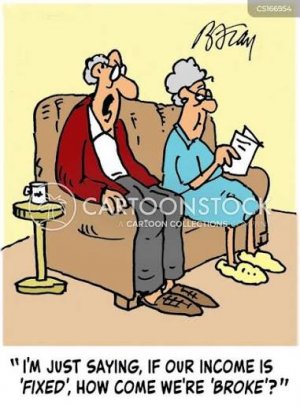

What does fixed income actually mean?

- Thread starter SueBee

- Start date

Aunt Bea

SF VIP

- Location

- Near Mount Pilot

CaliS

girl next door

- Location

- West Coast, USA

In my humble opinion, it's fixed because when we were working - we could always look for a better paying job....

At my age, no one is going to hire me - so when I begin to collect my SS and draw from my 401K etc --- my income will be "fixed" more so than it was before.

Right now, my husband and I run a small construction business - so our income is customer dependent .... economy dependent - but not really "fixed" ....

Just my 2 cents

At my age, no one is going to hire me - so when I begin to collect my SS and draw from my 401K etc --- my income will be "fixed" more so than it was before.

Right now, my husband and I run a small construction business - so our income is customer dependent .... economy dependent - but not really "fixed" ....

Just my 2 cents

Knight

Well-known Member

Fixed income refers to a category of investments that provide regular interest or dividend payments over a specified period, with the principal amount returned at maturity. Common types of fixed-income products include government and corporate bonds. Essentially, fixed income investments are characterized by the obligation of the borrower to make fixed payments on a predetermined schedule. This type of investment is often considered lower risk and can help stabilize an investment portfolio by providing consistent income.

what is fixed income - Bing

what is fixed income - Bing

StarSong

Awkward is my Superpower

- Location

- Los Angeles Suburbs

I've always thought of fixed income as you're no longer employed so whatever funds are coming in (SS, disability, annuity or pension) won't rise more than the cost of living — if that.

When working, there's always the possibility of a promotion, raise, second job or job change.

Like @CaliS, DH & I are not on a fixed income. We still run a reduced version of our small business and it provides some income. This despite being in our early 70s and drawing SS.

When working, there's always the possibility of a promotion, raise, second job or job change.

Like @CaliS, DH & I are not on a fixed income. We still run a reduced version of our small business and it provides some income. This despite being in our early 70s and drawing SS.

Last edited:

I have heard seniors use the term "fixed income" when describing their financial situation. I don't believe it's a literally accurate phrase but more a declaration that their days of increasing income are over. Sure there's typically a COLA adjustment every year while on SS but the days of merit or annual raises and bounses are done.

So for a senior with no other income streams but SS it probably feels like their income is fixed for life.

So for a senior with no other income streams but SS it probably feels like their income is fixed for life.

Paco Dennis

SF VIP

- Location

- Mid-Missouri

Yes. I feel dependant on the Government for my income, and that can change big time, so you use what they give u.for a senior with no other income streams but SS it probably feels like their income is fixed for life.

I have thought about "busking". A guy makes his living all over the world, playing his guitar and singing a bit. I could go for that!

CaliS

girl next door

- Location

- West Coast, USA

Kudos! Nothing like trying to run a small business in Southern CaliforniaI've always thought of fixed income as you're no longer employed so whatever funds are coming in (SS, disability, annuity or pension) won't rise more than the cost of living — if that.

When working, there's always the possibility of a promotion, raise, second job or job change.

Like @CaliS, DH & I are not on a fixed income. We still run a reduced version of our small business and it provides some income. This despite being in our early 70s and drawing SS.

DailyArtsyCrafter

Crafter Writer Artist

- Location

- Southeastern US

To me it means that the regular income off of which a person lives, whatever the source and however often, is the same amount at each receipt. There is no opportunity to increase it through overtime, bonuses, raises in position/income, etc. Any increases are not enough to improve the status of life.

I guess a fixed income could be high-level, like a large annuity, old or new money inheritance or something, any income that is parceled out in the same amount. For most, it means living with the basics and careful expenditures. If the income can't pay for basic, market-rate housing, food, medical and necessities, and it falls at or below what the government has established as poverty level, it is a low fixed income.

I guess a fixed income could be high-level, like a large annuity, old or new money inheritance or something, any income that is parceled out in the same amount. For most, it means living with the basics and careful expenditures. If the income can't pay for basic, market-rate housing, food, medical and necessities, and it falls at or below what the government has established as poverty level, it is a low fixed income.

Bretrick

Well-known Member

- Location

- Perth Western Australia

One meaning would be White Collar workers being on a salary.

A predetermined amount of salary for a set pay period.

So each fortnight/month a set amount is deposited into your account.

A predetermined amount of salary for a set pay period.

So each fortnight/month a set amount is deposited into your account.

One meaning would be White Collar workers being on a salary.

A predetermined amount of salary for a set pay period.

So each fortnight/month a set amount is deposited into your account.

yes that would be a fixed income, literally

but whenever I hear people use the term they mean they are on a govt pension or a superannuation pension, not a salary

Trade

Well-known Member

"I'm on fixed income" is a lie some seniors tell in an attempt to elicit sympathy. The reality is we seniors have it made. We get a COLA every year on our Social Security and we are the only group in this country that gets universal single payer health care (Medicare). We have it made in the shade compared to most young people.

Last edited:

StarSong

Awkward is my Superpower

- Location

- Los Angeles Suburbs

Depends on the size of those SS checks. Many struggle to make ends meet with meager checks because of short or interrupted work histories, low wages and/or years of under-the-counter remuneration."I'm on fixed income" is a lie some seniors tell in an attempt to elicit sympathy. The reality is we seniors have it made. We get a COLA every year on our Social Security and we are the only group in this country that gets universal single payer health care (Medicare). We have it made in the shade compared to most young people.

StarSong

Awkward is my Superpower

- Location

- Los Angeles Suburbs

Are you also in So Cal?Kudos! Nothing like trying to run a small business in Southern California

DailyArtsyCrafter

Crafter Writer Artist

- Location

- Southeastern US

Depends on the size of those SS checks. Many struggle to make ends meet with meager checks because of short or interrupted work histories, low wages and/or years of under-the-counter remuneration.

You said that perfectly. I hear people mentioning the average SS check is over $1,000. Some say they are around $1,500 or so. I, like others, wonder who they are talking about.

Trade

Well-known Member

Depends on the size of those SS checks. Many struggle to make ends meet with meager checks because of short or interrupted work histories, low wages and/or years of under-the-counter remuneration.

True. But they still get a COLA every year so it's not technically fixed income. And Medicare that those of us that have made it to 65 get.

Trade

Well-known Member

You said that perfectly. I hear people mentioning the average SS check is over $1,000. Some say they are around $1,500 or so. I, like others, wonder who they are talking about.I'm most familiar with recipients checks being in the $700s. Occasionally, $800 something, but not often. I wonder how and through whom these statistics are computed. Who, exactly, is being represented here? Doesn't seem like it's within the average American demographic. I think the average American now is in or nearing poverty. The struggling and poverty-stricken citizens seem to me to outnumber those with higher SS checks. Many worked all of their lives, since they were youth. They did the best that they could under the circumstances that you mentioned.

I think net wealth is a better indicator of how much poverty there is. In this country he top 10% own 68% of the wealth and the bottom 50% own 2.5%. I'd say most of those in the bottom 50% are living in what I would call poverty conditions.

You said that perfectly. I hear people mentioning the average SS check is over $1,000.

I dont understand your SS system - but the average can be 1000, but the majority of people well below that if a few at the top have much more.

the median level and the average can be quite different.

MACKTEXAS

Well-known Member

Here's what I found on the SSA website

The estimated average amount changes monthly. For example, the estimated average monthly Social Security retirement benefit for January 2025 is $1,976.

The estimated average amount changes monthly. For example, the estimated average monthly Social Security retirement benefit for January 2025 is $1,976.

MACKTEXAS

Well-known Member

Yes, I retired a year early which reduced my benefit. Those who retired late get a higher benefit. Those who had lower earnings get less, and so on, so that the average has little meaning overall.the median level and the average can be quite different.

CaliS

girl next door

- Location

- West Coast, USA

Yes, Riverside. It's amazing the hoops they make us jump through (gov)....Are you also in So Cal?

OneEyedDiva

SF VIP

- Location

- New Jersey

I always thought "fixed income" meant those living on SS or pension (or both) that they do not expect to increase, at least not significantly. Yes we get SS COLAs but in reality, they do not keep up with the real life cost of living increases that happen before and after the COLAs. And since I usually heard the term when people said they couldn't afford to do this or that because they are on a "fixed income", I never thought of that term being applied to those in higher income brackets.

She got $600 a month, but lived a good life. She lived in a nice senior apartment (public housing that took 33% for rent), had plenty of classic dresses and suits from her working years and was on PAAD, a program under which she only had to pay $5 for each of her meds. She even had more in savings than the median amount Americans are estimated to have in their savings accounts these days.

I've seen the average SS check being quoted as even higher than $1,500. I gross a little more than $1,500, but considering I retired early (50), half of my working years were as a low wage earner and I took SS early, I feel blessed to get what I'm getting. My mother who worked various jobs including factories, as a presser at a cleaners and as a housekeeper, only had SS taken out during part of her working years.You said that perfectly. I hear people mentioning the average SS check is over $1,000. Some say they are around $1,500 or so. I, like others, wonder who they are talking about.I'm most familiar with recipients checks being in the $700s. Occasionally, $800 something, but not often. I wonder how and through whom these statistics are computed. Who, exactly, is being represented here? Doesn't seem like it's within the average American demographic. I think the average American now is in or nearing poverty. The struggling and poverty-stricken citizens seem to me to outnumber those with higher SS checks. Many worked all of their lives, since they were youth. They did the best that they could under the circumstances that you mentioned.

She got $600 a month, but lived a good life. She lived in a nice senior apartment (public housing that took 33% for rent), had plenty of classic dresses and suits from her working years and was on PAAD, a program under which she only had to pay $5 for each of her meds. She even had more in savings than the median amount Americans are estimated to have in their savings accounts these days.

CaliS

girl next door

- Location

- West Coast, USA

According to Google "The average Social Security check in California varies by group, with the average retired worker receiving approximately $2,002.39 per month as of July 2025" .... Honestly, I do not see how anyone could live on $700 a month anywhere?!

Aunt Bea

SF VIP

- Location

- Near Mount Pilot

I enjoy seeing the income averages, medians, etc… but what really counts is what we are able to do with the income that we have.

Some people are broke and living hand to mouth on six figure incomes and some people live quite comfortably on what the government considers a poverty level income.

Some people are broke and living hand to mouth on six figure incomes and some people live quite comfortably on what the government considers a poverty level income.