...And they aren't planning for retirement. Living in the moment. Yes, I'm very concerned. Meanwhile, China is making all the money.

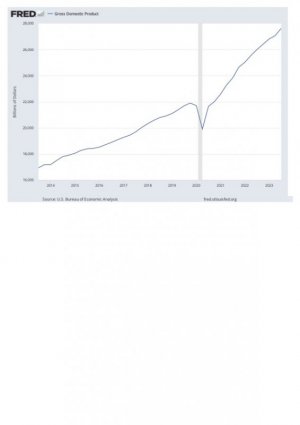

You might need to pay more attention to unbiased global economy reports. The US is far and away doing better than any other economy, at the present time.

Does that mean everybody is fat and happy? Not in the slightest, but that's the price we pay for a capitalist economic system, and voting for those who shred the social safety net every chance they get. We have a patchwork, dysfunctional healthcare system because

that's what people voted for. I don't agree with it, but if I'm outvoted, I can't complain.

And China? You are way off on that one. The COVID epidemic devastated China due to Xi's massive mismanagement. For 2022

alone, COVID deaths in the US were just over 244K. For 2022, COVID deaths in China were

1.3 million - and for China, that was an improvement over the last 2 years!

This is a 6-page article. BTW, this was

before all the articles about the massive RE implosion in China, estimated in the

trillions of yuan. Just the latest August 2023 bailout will cost China's government USD$586 billion. Here's an excerpt:

China's Great Leap Backward: So much for the next dominant superpower

Salon.com by Joe Tauke, August 2023

[free link]

MSN

The "Chinese century" is over.

After all the prognostications, projections and proclamations of the past 20 years asserting that China would soon overtake the U.S. as the world's dominant superpower, the People's Republic is now facing twin perpetual headwinds, and has no realistic options for countering either of them.

The first could accurately be described as the strongest long-term force driving the fates of all great powers: demographics. What was, for many previous decades, China's ultimate advantage — its never-ending supply of working-age laborers — peaked at almost exactly one billion people in 2010, according to the Chinese census. The next census, in 2020, revealed that for the first time since China's economic liberalization in the 1970s, the working-age cohort had shrunk, decreasing by more than 30 million.

The U.N. estimates that this group will continue to contract, dropping to 773 million by 2050. (In other words, between now and then China is likely to lose a number of workers larger than the entire population of Brazil.) The under-14 population will also fall in that same period, from just over 250 million in 2020 to a median projection of 150 million in 2050. Not only will the workers be disappearing, but nobody is expected to replace them.

Every age-related trend in China is going in the wrong direction. The nation's median age, once well below the Western world's, is now older than America's and headed further north with every passing year. Deaths outnumbered births last year for the first time since 1961.

The fertility rate, which normally must be at 2.1 children per adult woman just to maintain a steady population, has slipped to below 1.1 — a figure made worse by the fact that, unlike in virtually every other country on the planet, China doesn't have a relatively even gender split in its adult population, the long-term result of male favoritism combined with the central government's infamous one-child policy. Basic math dictates that tens of millions of these "extra" men will never start families of their own.

To compound the problem even further, women in China have indicated lower interest in having children than ever before; more than two-thirds have expressed "low birth desire." According to Prof. James Liang of Peking University, fertility rates in Beijing and Shanghai have fallen to an astonishing 0.7, "the lowest in the world."

In Japan, economic stagnation produced a period that was called the "Lost Decade." That stagnation eventually persisted so long that some began to refer to it as the "Lost Generation." In China, an even more ominous buzz-phrase has become popular online: The "Last Generation."

===========

Also, China's vaunted expansion into Third World countries was accomplished by loaning more billions to build highways, bridges, etc. The result is that China is owed money - but the percentage of non-performing global loans they made has risen from a normal 3% to a devastating 60%. Basically, many of those countries are essentially bankrupted, and China has little chance of repayment since they have insufficient reserves to take advantage of repossession by more investment.

As a measurement of performance, if a US bank had 60% of non-performing loans in their portfolio, they would be shut down immediately.

I also disagree with this idea "the Fed is out of control". The Federal Reserve operates to regulate banks and financial institutions. Period. Congress has forced them into the position of inflation control, which is actually NOT part of their mandate. Bernanke and Powell have done a very good job, however. It's a shame Congress can't get their act together, but that is mostly certainly not the Fed's fault.