Teacher Terry

Well-known Member

I read the article and it was. It appears to be the least painful of the choices.I think that was one of the suggestions thrown out there Terry.

I read the article and it was. It appears to be the least painful of the choices.I think that was one of the suggestions thrown out there Terry.

If they structured the reductions cleverly they could maybe avoid that, for example, base the percentage cut on Net Worth, that way the people who don't even need the SS income would have a larger percentage cut, and the people who need it would probably not need to be cut at all.Seniors currently on the financial edge will be tipped into the abyss of being unable to afford the basics of life if benefits are reduced.

I feel the same as @Alizerine about the word "entitlement". Yes, we're entitled because we worked for and earned the benefits. I view it as defined here:Social Security is not an Entitlement. People pay into the fund for their entire working life. An entitlement is something that people have NOT paid into.

The basic Medicare premium in 2023 was $164.90 and this year it's $174.70.Last year, for most people, Medicare premiums went up $4 a month, $6 the year before. in 2022 it went up $22, but the COLA adjustment was 8.7%, which more than covered even low SS benefits.

Yes, the cost of living continues to increase. Nothing new on that front.

A 3.4% SS bump is higher than I would have expected. Guess we'll see what SS has to say come October.

Thank you for the correction. You're absolutely right:The basic Medicare premium in 2023 was $164.90 and this year it's $174.70.

Are you referring to the article that is dated 5-15, compared to mine... dated 5-28 (scroll down to 5-31)The basic Medicare premium in 2023 was $164.90 and this year it's $174.70.

@jpstrap

You wrote:

"After all, never-ending wars are more important than the security of our older folks."

It sure seems that way! How many billions have been sent to other countries while the claim is that there isn't enough in the budget to provide more aid to those who are poverty stricken, including seniors!

Because of the No Poltics rule, I won't expound.

@Harry Le Hermit I was hoping you'd weigh in. If you go back to my original post and click on the blue MSN, you'll see the article that shows a revised estimate. I believe that article may be more recent than the one you linked.

View attachment 348930

Mary Johnson, former Social Security and Medicare analyst for nonprofit Senior Citizens League, and still follows COLA changes, suggested that for 2025, it could jump 3.2 percent, higher than the forecast she provided last month of 3 percent [ᵉᵐᵖʰᵃˢⁱˢ ᵃᵈᵈᵉᵈ]

In addition, Social Security as a retirement plan was thrust upon people. The people didn't vote on it, it was drafted by the Committee on Economic Security, passed by congress as part of The New Deal, and quickly signed by the president. It promised an old-age retirement income by imposing a deduction on certain worker's earnings. Most female workers were excluded at first as the Act did not apply to female-dominated fields such as domestic service, nurses, and teachers.I feel the same as @Alizerine about the word "entitlement". Yes, we're entitled because we worked for and earned the benefits.

My mother worked in many jobs. She worked for Wright's Aeronautics , she worked as a presser in the cleaners and in her later years as a housekeeper for a family whose husband became one of her doctors. As you pointed out, the domestic service workers lost out on having social security taken out. Because she worked blue collar jobs, my mother did get $600 a month, which she managed to live comfortably on.In addition, Social Security as a retirement plan was thrust upon people. The people didn't vote on it, it was drafted by the Committee on Economic Security, passed by congress as part of The New Deal, and quickly signed by the president. It promised an old-age retirement income by imposing a deduction on certain worker's earnings. Most female workers were excluded at first as the Act did not apply to female-dominated fields such as domestic service, nurses, and teachers.

I mean to point out that we are required to contribute to SS whether or not we want to, and are absolutely entitled to the benefits.

Fun Fact: The first person to apply for SS retirement got 17 cents after contributing only 5 cents. He applied one day after the Social Security Act was enacted.

Yes Harry. At first I didn't see the date on your article. I'm sure I saw another article that said the revision was up from 2.66% the first forecast. In any case, I've seen both those projections. It got to be confusing. And here's yet another article published today that gives the projected COLA as 3%. We'll just have to wait and see as they all state the figures could change over the coming months.Are you referring to the article that is dated 5-15, compared to mine... dated 5-28 (scroll down to 5-31)

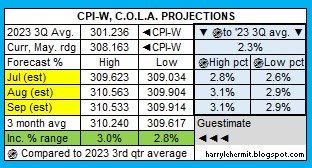

The senior citizen league is coming in with an upward revision to 2.66%, which rounding is 2.7%.

With May's release on June 12th, the expectation is a monthly change of 0.0% ~0.1%, dependant on rounding.

Yes, it is all over the place, but we are likely entering slowing of the rate of inflation. What should be considered is the proposed changes to the Social Security Act, that would use either CPI-W or CPI-E (whichever is higher). Alas, the proposal is currently sitting in the Senate Finance Committee.Yes Harry. At first I didn't see the date on your article. I'm sure I saw another article that said the revision was up from 2.66% the first forecast. In any case, I've seen both those projections. It got to be confusing. And here's yet another article published today that gives the projected COLA as 3%. We'll just have to wait and see as they all state the figures could change over the coming months.

Social Security COLA for 2025: Benefits and Economic Implications

You're welcome of course Star. I know what you mean about the years running together. For me the days do too!Thank you for the correction. You're absolutely right:

It was 170.10 in 2022 but was decreased to $164.90 in 2023, then bumped to $174.70 in 2024.

Sometimes the years seem to run together.

I think it's unfair to use the CPI they've been using for seniors. I wish they would change it to the CPI-E. I know they've been kicking that idea around for a while.Yes, it is all over the place, but we are likely entering slowing of the rate of inflation. What should be considered is the proposed changes to the Social Security Act, that would use either CPI-W or CPI-E (whichever is higher). Alas, the proposal is currently sitting in the Senate Finance Committee.

It would help some of the current issues, although not resolving them completely. The current CPI-U (headline) is 313.548; CPI-W is at 307.811; and CPI-E is 341.904. (All have 100 as base... at the same start time).

As an example, the current year C.O.L.A. would be 4.0% if CPI-E were used, instead of 3.2%

It wouldn't be "depleted" if they had put it in investments instead of the general funds and used it as their own "piggy bank". With all the baby boomers retiring think how much the gov would have then!I "said" it before and I'll "say" it again....I sure hope you're right! I've been following this situation for years. Analysts have been predicting the cut years before the Social Security Board of Trustees released its reports stating the possibility SS will be cut across the board. At first the cut was projected to be 24% and a couple of years later than stated below. Here is an excerpt from one of several articles I've read over the years about the projected cut in our SS:

"A Social Security funding crisis could be on the horizon if policymakers fail to take action to protect the program in the next decade, threatening a 23% cut to all 70 million recipients' annual benefits, a new report claims.

The analysis by U.S. Budget Watch 2024, a project from the public policy organization Committee for a Responsible Federal Budget, predicts that if the primary trust fund used to bankroll Social Security runs out of reserves by 2033, the average newly retired dual-income couple would see an immediate reduction of $17,400. Single-income couples would lose $13,100.

The CRFB’s projections are based on an annual report released in March by the Social Security Board of Trustees, which predicted in January that the Old-Age and Survivors Insurance (OASI) Trust Fund will reach insolvency in the next 10 years without comprehensive revenue and benefits adjustments.

By that time, today’s youngest retirees, who are 62 years old, will be 72, and today's 57-year-old workers will have reached the minimum retirement age.

Once the trust fund is depleted, by law, it can only spend as much as it receives in incoming revenue, resulting in cuts for all beneficiaries. The warning comes as candidates in the next presidential election face partisan pressure to promise not to touch Social Security, a move that the CRFB says would spell disaster."

Will Social Security Benefits Really Get Slashed by 23% in the Next Decade?.

@Teacher Terry

Same here.I used to read that SS was one of the "legs" in the "three legged stool" that was savings, pension and SS.

You got great advice that I'm glad you and your husband followed.Same here.

My & DH's parents schooled us to not imagine we could live off SS for retirement. Being self-employed, meaning no pensions, we were responsible for two legs of that stool.

The wage earner feels the same way. Wages aren't keeping pace with inflation. It irks me when I hear about the politician who went to DC with little or no net worth and at the end of their political career have a bulging net worth. I'm not sure how that math works, but it doesn't sound real honest.That's fine, but then they will also most likely increase the Medicare payment.

Then the news, which is staffed by 95% people younger than 55, will yell and shout that this is a good news story! But that's because those young people don't know the right questions to ask the older people, like,

"So how much has your rent/groceries/gas/Medicare payment increased in the past year?"

Old Person: "Oh, they all increased about 5% to 9%."

"So then, at 3.4% increase you're still falling behind financially."

Old Person: "Yes."

Then one wing of the political spectrum will use the news to scream and cry that all these "entitlements" must end!!!!! Can you imagine if that actually happened - if they killed Social Security next year, we all get $0.00? The churches would have to build Senior Only Homeless Shelters right quick because some Seniors are so physically vulnerable to getting assaulted and robbed by younger people - even by fellow Seniors, but even old guys start to lose their strength over time. But some old people still go crazy over time, so they can still beat on other Seniors if they have brain diseases.

But yeah - that's what would happen. A vast network of Seniors-Only Shelters would have to be opened. Then the young news reporters would be there, creating "good news" stories about Senior Only Shelters - as IF that is actually a good thing!?

This is why I have lost interest in much of the news. Same old arguments repeated ad infinitum, with few real solutions.

I'm sorry to be a Debbie Downer about this. To keep up with inflation and Medicare, maybe it should rise 9%? Maybe?

I'll bet this pisses off young people when they see the gov't. automatically increase Social Security, but the gov't, will not automatically increase the Federal Minimum Wage.

There's also whole groups of people who had low-paying jobs for 40 to 50 years. A whole class or people who never earned enough to also stay out of homelessness and save for retirement.My mother worked in many jobs. She worked for Wright's Aeronautics , she worked as a presser in the cleaners and in her later years as a housekeeper for a family whose husband became one of her doctors. As you pointed out, the domestic service workers lost out on having social security taken out. Because she worked blue collar jobs, my mother did get $600 a month, which she managed to live comfortably on.

Even though SS didn't get a vote from the people, for many it became a lifeline. Can you imagine the percent of seniors who would not have any sort of income if it wasn't for social security?! Poverty for seniors is already dismally high. Because many people either don't think to save for retirement or just can't, social security at least provides something, even though it is not enough for many to live on. I used to read that SS was one of the "legs" in the "three legged stool" that was savings, pension and SS.

Regarding your Fun Fact...that's a ...

View attachment 349099

People (including SAHMs) who paid little into SS get small SS checks from their own working record, or half of their spouse's or ex's. It has always been thus.There's also whole groups of people who had low-paying jobs for 40 to 50 years. A whole class or people who never earned enough to also stay out of homelessness and save for retirement.

Anyone who was a stay-at-home mom and not married to a millionaire, or God forbid, never married at all and was just a domestic partner, falls into that category of person.

Stay-at-home moms who divorce or are divorced don't get much from SS for their years of service.

Why should a woman have to be married to do well financially? There is nothing about savings and personal finance that a women can't do as well as a man.There's also whole groups of people who had low-paying jobs for 40 to 50 years. A whole class or people who never earned enough to also stay out of homelessness and save for retirement.

Anyone who was a stay-at-home mom and not married to a millionaire, or God forbid, never married at all and was just a domestic partner, falls into that category of person.

Stay-at-home moms who divorce or are divorced don't get much from SS for their years of service.

CPI-W, came in a bit above that projection at 0.114%. Based on that, I would put forth this projection...With May's release on June 12th, the expectation is a monthly change of 0.0% ~0.1%, dependant on rounding.

Same here.

My & DH's parents schooled us to not imagine we could live off SS for retirement. Being self-employed, meaning no pensions, we were responsible for two legs of that stool.

My mother worked in many jobs. She worked for Wright's Aeronautics , she worked as a presser in the cleaners and in her later years as a housekeeper for a family whose husband became one of her doctors. As you pointed out, the domestic service workers lost out on having social security taken out. Because she worked blue collar jobs, my mother did get $600 a month, which she managed to live comfortably on.

Even though SS didn't get a vote from the people, for many it became a lifeline. Can you imagine the percent of seniors who would not have any sort of income if it wasn't for

Same here.

My & DH's parents schooled us to not imagine we could live off SS for retirement. Being self-employed, meaning no pensions, we were responsible for two legs of that stool.

social security?! Poverty for seniors is already dismally high. Because many people either don't think to save for retirement or just can't, social security at least provides something, even though it is not enough for many to live on. I used to read that SS was one of the "legs" in the "three legged stool" that was savings, pension and SS.

Regarding your Fun Fact...that's a ...

View attachment 349099

Same here.

My & DH's parents schooled us to not imagine we could live off SS for retirement. Being self-employed, meaning no pensions, we were responsible for two legs of that stool.